Quick search

CTRL+K

Quick search

CTRL+K

Political Expert

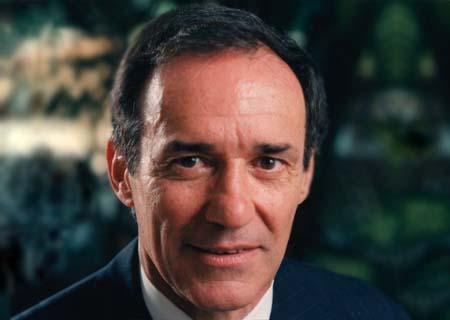

Specializing in US foreign policy, states in transition, and global political risk, Ian Bremmer is one of the world’s leading global political risk researchers and consultants.

He helps business leaders, policy makers, and the general public make sense of the world around them by providing clear-headed insights on critical global issues and how political developments move markets.

Dubbed the “rising guru” in the field of political risk by The Economist, Bremmer is the president and founder of the Eurasia Group, the world’s leading political risk research and consulting firm. He is also the host of GZERO World with Ian Bremmer, which airs weekly on US national public television, and is a frequent guest on CNN, Fox News, MSNBC, BBC, Bloomberg, and many others globally.

Bremmer is credited with bringing the craft of political risk to financial markets, creating Wall Street’s first global political risk index (GPRI), and establishing political risk as an academic discipline.

His definition of emerging markets — “those countries where politics matters at least as much as economics for market outcomes”— has become an industry standard. “G-Zero,” his term for a global power vacuum in which no country is willing and able to set the international agenda, is widely accepted by policymakers and thought leaders.

A prolific writer, Ian Bremmer is the author of 10 books, including the New York Times bestseller, Us vs Them: The Failure of Globalism, which examines the rise of populism across the world. He also serves as the foreign affairs columnist and editor at large for TIME magazine.

In addition, Bremmer currently teaches at Columbia University’s School of International and Public Affairs, and was previously a professor at New York University.

Bremmer earned a master’s degree and a doctorate in political science from Stanford University, where he went on to become the youngest-ever national fellow at the Hoover Institution.

He received his bachelor’s degree in international relations from Tulane University.

Contact us at Banking Speakers or find more at Futurist Speakers

At a time when so many challenges transcend borders, the need for international leadership has never been greater. Leaders have the leverage to coordinate multinational responses to transnational problems and the wealth and power to persuade other governments to take actions they wouldn’t otherwise take.

They pick up the checks that others can’t afford and provide services no one else will pay for. But in years to come, there will be no global leadership, because there is now no single country or bloc of countries with the political and economic muscle to drive an international agenda.

America is struggling to pay its bills, Europe is busy trying to save the eurozone, and emerging powers are wrestling with too many complex challenges at home to accept risks and burdens abroad.

A world without leaders will undermine our ability over the next decade to keep the peace in Asia and the Middle East, to grow the global economy, to reverse the impact of climate change, to feed growing populations, and to protect the most basic of all necessities – air, food, and water. Its effects will be felt in every region of the world, even in cyberspace.

Ian Bremmer, an expert on international politics and its impact on global markets, will detail the following:

A generation after communism’s collapse, the future of free market capitalism isn’t what it used to be. Public wealth, public investment, and public ownership have made a stunning comeback. Certain that command economies are doomed to fail but afraid that truly free markets will spin beyond their control, the political leadership in China, Russia, the Arab monarchies of the Persian Gulf and other authoritarian states have invented a new system: state capitalism.

Each in their own way, they’re using markets to create wealth that can be directed toward the achievement of political goals. Governments now dominate key domestic economic sectors. The oil companies they own control three-quarters of the world’s crude oil reserves. They use state-owned companies to manipulate entire economic sectors and industries.

They own enormous investment funds that have become vitally important sources of capital for Western governments and banks weakened by financial crisis. An expert on the impact of politics on market performance, Ian Bremmer illustrates the rise of state capitalism and details its long-term threat to relations among nations and the future of the global economy.

At this presentation audiences will learn about:

The rise of state capitalism

Why it exists and how it works

The threat to free market capitalism

Alternate option for market clients:

The Rise of State Capitalism

The financial crisis and global recession hastened the transition from a G7 to a G20 world, one in which developing states that don’t share US assumptions about the virtues of free market capitalism now have a seat at the international bargaining table.

In fact, a generation after communism’s collapse, public wealth, public investment, and public ownership have made a stunning comeback. Certain that command economies are doomed to fail but afraid that truly free markets will spin beyond their control, the political leadership in China, Russia, the Arab monarchies of the Persian Gulf and other authoritarian states have invented a new system: state capitalism. Each in their own way, they’re using markets to create wealth that can be directed toward the achievement of political goals.

Governments now dominate key domestic economic sectors. The oil companies they own control three-quarters of the world’s crude oil reserves. They use state-owned companies to manipulate entire economic sectors and industries.

They own enormous investment funds that have become vitally important sources of capital for Western governments and banks weakened by financial crisis. The great 21st century challenge for America’s leaders will be to adapt to changing circumstances in ways that extend that indispensability.

To continue to lead in a world where states are overwhelmingly focused on domestic challenges, the United States must find ways to build partnerships with like-minded, willing, and able governments. An expert on the impact of politics on market performance, Ian Bremmer illustrates the rise of state capitalism and details its long-term threat to relations among nations and the future of the global economy.

Alternate option for corporate clients:

The Next Major Global Risk: Capitalism vs ?

The financial crisis and global recession hastened the transition from a G7 to a G20 world, and developing states that don’t share Western assumptions about the virtues of free market capitalism now have a seat at the international bargaining table. In fact, a generation after communism’s collapse, public wealth, public investment, and public ownership have made a stunning comeback. What does this trend toward state-driven capitalism mean for CEOs trying to do business around the globe?

The fallout from the still-unfolding global financial crisis provides several perfect examples of “fat tail” risk, those that flow from the low-probability, high-impact events that generate upheaval more often than we think.

Bremmer shares with audiences how an understanding of the political dynamics generated by the financial crisis helps us forecast market risks, why politics matter more than ever for market performance, why the world’s wealthiest countries have begun to behave like emerging market states, and what all this means for investors and companies.

Videos

The profiles and images embedded on these pages are from various speakers and talent.

These remain the property of its owner and not affiliated with or endorsed by Banking Speakers

Fee ranges listed on this website are intended to serve as a guideline only and in currency USD.

Economic Futurist

No results available

Reset© All rights reserved. Banking Speakers is a division of Hesketh Media LLC